Egan Associates was requested by the Australian Financial Review for the third year in a row to identify the long-serving CEOs who have significantly outperformed their peers over the most recent five-year time frame.

Only the top 200 companies by market capitalisation at 31 March 2015 with CEOs who had been serving for five years or longer were considered in the analysis, which assessed companies based on their total shareholder return, return on equity and revenue growth over the last five years.

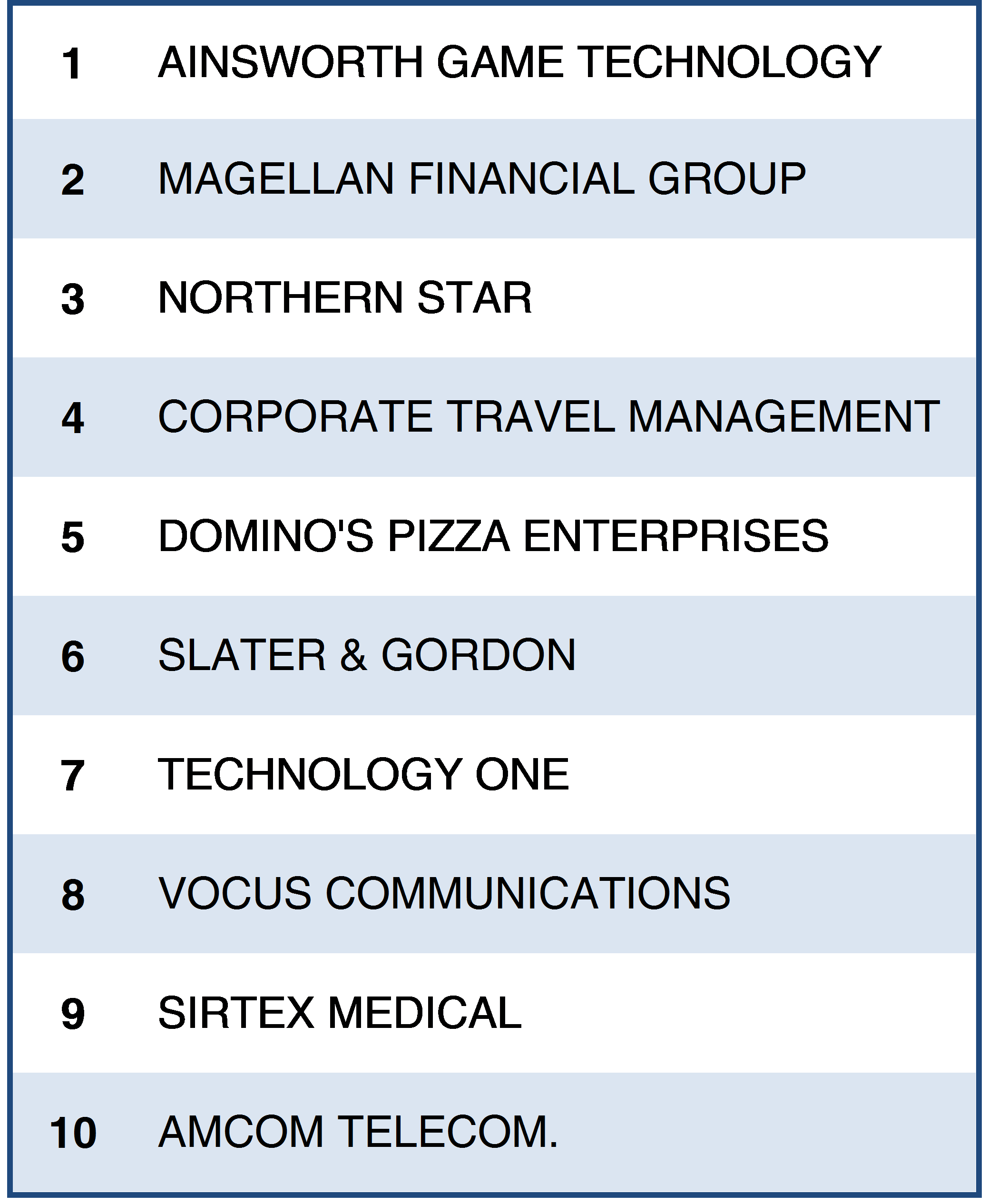

The top ten companies as assessed by these metrics were as follows:

The Australian Financial Review’s full feature can be found in May’s BOSS Magazine published on 8 May.

Of the top ten companies, five are led by CEOs or Executive Chairman who are founders – their performance is a testament to their ability.

”Entrepreneurs with the passion, knowledge and expertise who can engage staff can remain successful for a long period of time,” Egan Associates Chairman and Founder John Egan said.

They are often rewarded well for their success, achieving rewards above non-founder CEOs, although this generally requires a level of commitment over many years often without significant reward.

“Their success often arises from many years of hard work pursuing a vision with a level of tenacity often not present among senior executives in established corporate roles,” John Egan said.

“For every success there are a greater number of hard working, committed and inspiring individuals who fail to realise their dream due to either lack of capital or similar offerings entering the market which better capture contemporary and fast moving appetites.”

Critical for a successful entrepreneur is developing the right marriage with an independent Board, according to John Egan.

“It’s important to have a Chairman who implements appropriate governance and offers enough direction to control the outrageous while not putting a noose around the fast moving, energetic entrepreneur who will always want to explore new horizons,” he said.

Some companies, such as Ainsworth Gaming Technology and Magellan Financial Group, with continued revenue growth and return on equity performance complementing their significant rise in share price over the five-year period, have outperformed other companies, being placed in our top 10 three years in a row.

Yet, past performance is as ever not a reliable indicator for future gains, with other companies presently absent who had been in the top ten in prior years. They made way for forceful newcomers, which included the telco Vocus and gold miner Northern Star.

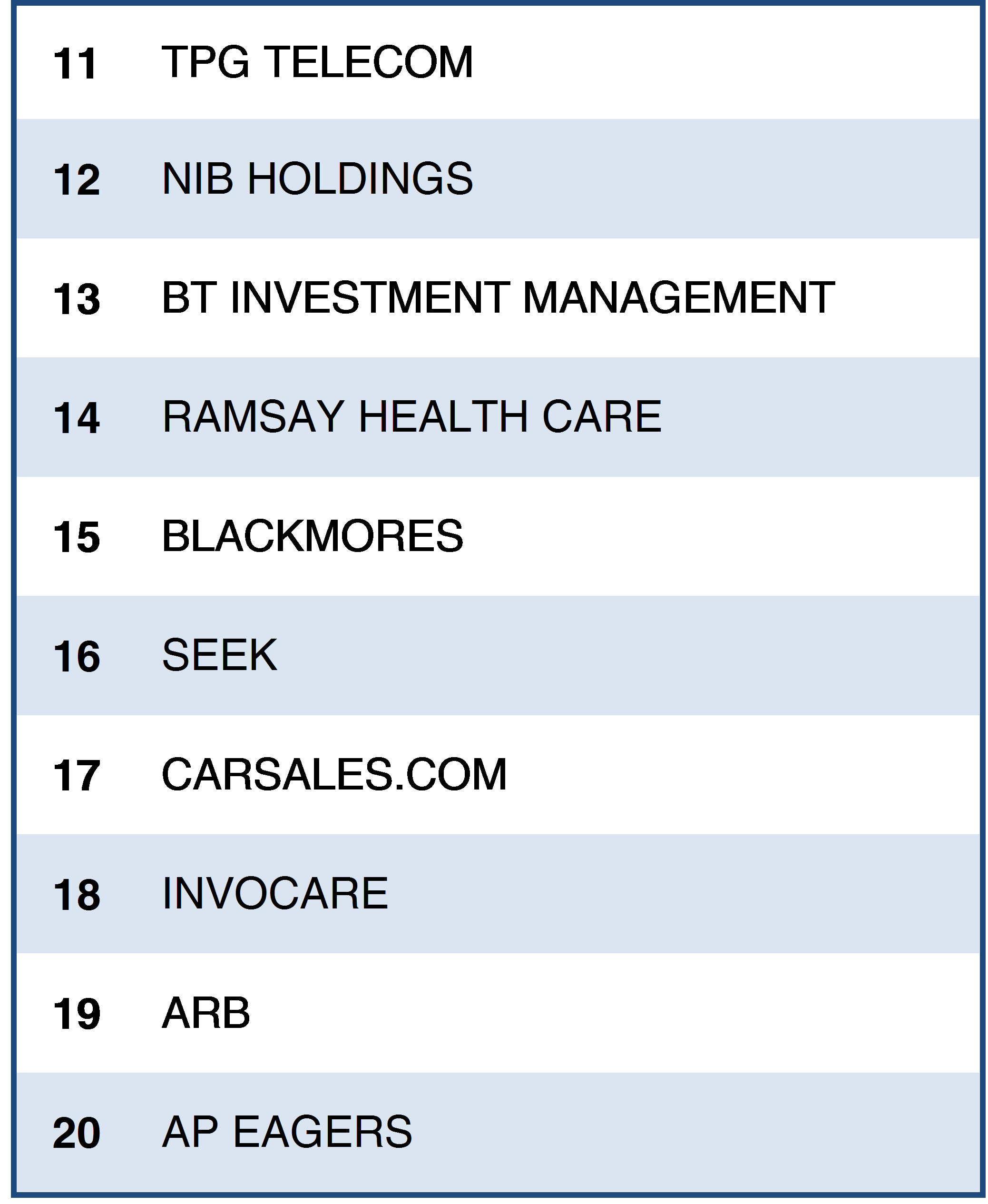

Companies that just missed out on making the top ten, but performed well enough to reach the top 20, can be found below:

Methodology notes:

- The largest 200 companies by market value listed on the ASX as at 31 March 2015, excluding companies that are foreign registered, externally managed funds and investment trusts where KMPs are employed by the responsible entity for the trust. Companies excluded that were not listed for at least four years at 31 March 2015.

- CEO must have been in their role or in an equivalent leading role for at least five years at 31 March 2015.

- Companies were ranked based on revenue growth, total shareholder return and return on equity and then given a combined ranking. Total shareholder return was assigned double the value of the other metrics.

- Geometric mean for revenue growth, total shareholder return (TSR) and return on equity over five years were used. In the calculation of TSR, 20-day smoothing was used. Where data was unavailable, the mean was calculated for available years.

- S&P Capital IQ data, Annual Reports for 2009 to 2014 and announcements lodged with the ASX.